Bangladesh Garment Export Industry Going Forward

Let’s assume that the BGMEA data is flawed, and Bangladesh is not home to the world’s most successful garment exporting industry.

Let’s assume that the international institutions’ data is accurate and that Bangladesh’s garment exporting industry is moving down from decline to collapse.

What you are seeing is not some short term blip that will disappear in a few months, but rather the culmination of an industry-wide new sourcing strategy, whereby major importers, having recognized that global garment demand is in a long term state of decline, have changed their sourcing strategies to severely diminish less important garment exporting countries.

If this be the case we have to ask, is this downward trend reversible and if so what steps can the Bangladesh take?

The short answer is YES. We can create a viable strategy which will return your customers to Bangladesh This will not be easy. It will certainly be costly.

However, before developing any potentially successful strategy, the Bangladesh industry, specifically BGMEA, would have to meet two requirements.

BGMEA would need to accept the existence of the problem.

BGMEA would need to accept that they lack the credibility to sell the strategy to their potential customers.

Bangladesh faces a number of serious problems.

Where once the Bangladesh garment exporting industry was trapped in the commodity garment sector, today the scope of their industry has been further reduced to the point where they are limited to a single product. With 60% of garment exports reduced to woven cotton pants - 70% if we include other fibers - the future of the Bangladesh has become dependent on that single product. When we consider the most recent data form the U.S. Office of Textiles and Apparel, we can see that not only are U.S. imports of cotton pants declining, but Bangladesh’s share of the shrinking market is also declining.

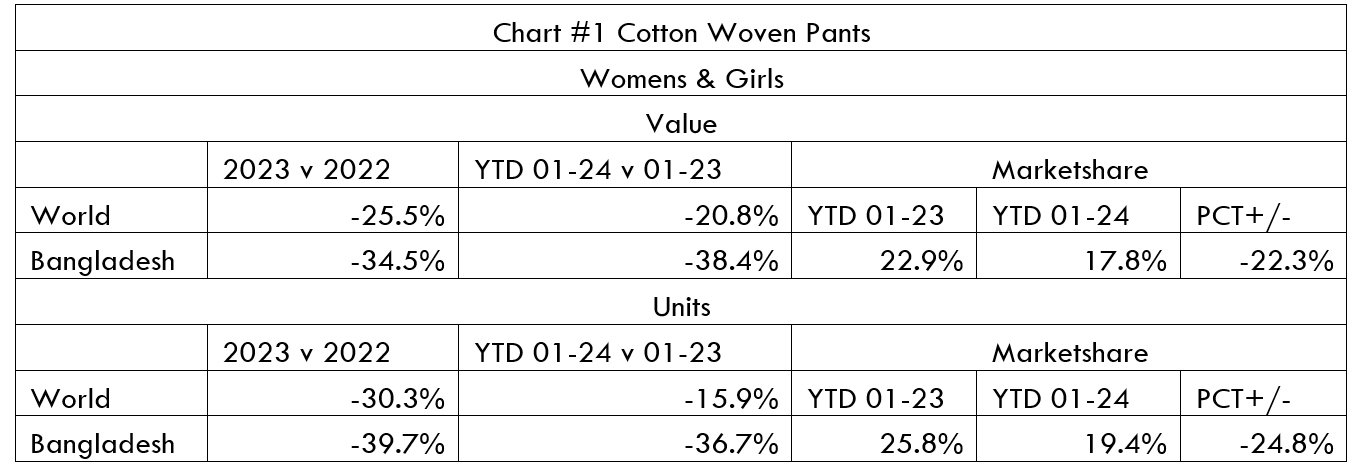

As we can see from Chart #1 below, US Imports of women’s and girl’s (W&G ) woven cotton pants as measured in value declined by 25.5% in 2023 compared with 2022. The situation marginally improved, at least for imports from all supplying countries to a decline of 20.8% in the period year-to-date (YTD) January 2024 compared with the same period in 2023. Regrettably, Bangladesh did not benefit, with US imports again declining by 34.5% in 2023 and 38.4% in YTD January 2024.

Imports, to the U.S. measured in units showed similar results. Imports from Bangladesh fell by 30.3% for the period 2023 compared with 2022 but improved markedly to 15.9% in YTD January 2024 compared with the same period in 2023. Once again, . regrettably, Bangladesh did not benefit, with US imports declining by 39.7% % in 2023 and 36.7% in YTD January 2024.

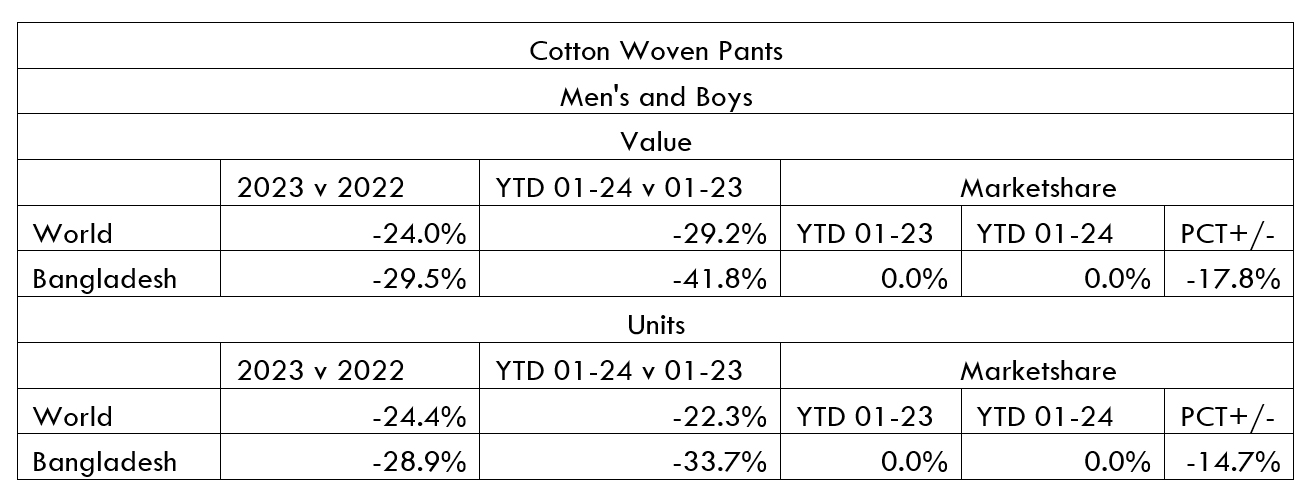

Chart #2 - Men’s & Boy’s tells the same bleak story.

US Imports of W&G woven cotton pants as measured in value declined by 24.0% in 2023 compared with 2022 but continued to decline to 29.2% in YTD January 2024 compared with the same period in 2023. Regrettably, once again, Bangladesh did not benefit, with US imports declining by 29.5% in 2023 and 41.8% in YTD January 2024.

Imports, measured in units ,showed similar results, with imports from all supplying countries falling by 24.4% in 2023 and YTD January 2024 showing some improvement falling 22.3%.

Regrettably, Bangladesh did not benefit, with US imports declining by 38.9% % in 2023 and 33.7% in YTD January 2024.

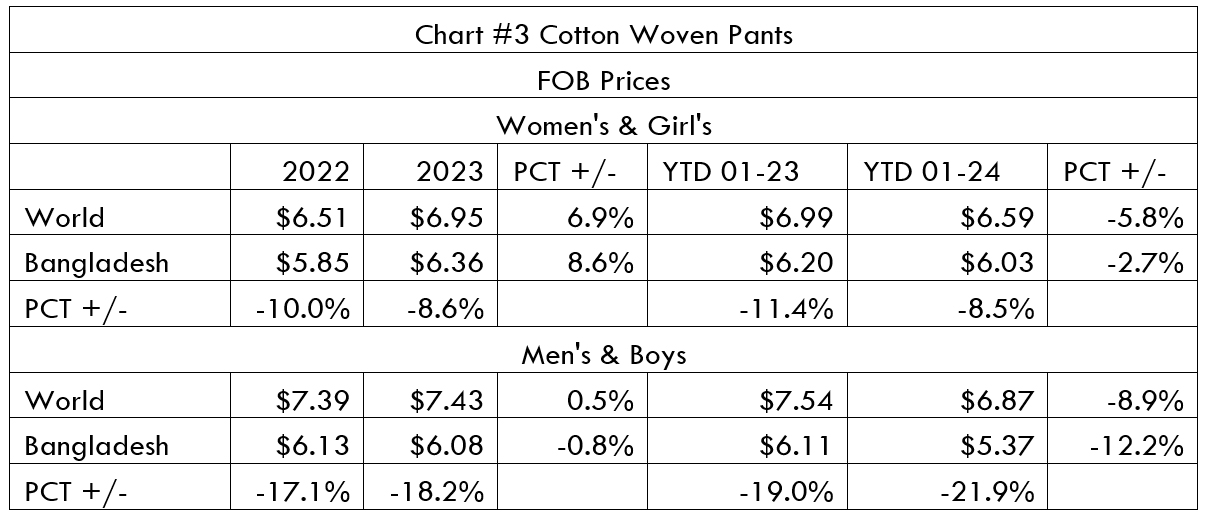

As we can see from Chart #3, an analysis of FOB prices further shows the serious problems facing Bangladesh exports.

Bangladesh offers some of the very lowest FOB prices in the industry, yet the industry is failing. Customers are leaving, at an ever increasing rate. Clearly, Bangladesh factories are not offering what their customers want.

Success in business is not based on some esoteric philosophy or even some new cutting edge technology. Indeed it is simple: Find out what your customer wants and give it to them.

The problem here is not just about product. Demand for cotton pants is falling but it is still a major garment product. The question is why are your customers leaving Bangladesh to go elsewhere?

Clearly. it is not price. Indeed, based on the most recent data, Bangladesh is reaching the point where if FOB prices were $0, the cost to the customer would be too high.

In normal times, reduced orders will cause disruption. The industry will shrink. Many factories will go out of business. However, the industry will survive. Foreign owned factories with global customer bases will continue to operate. Locally owned factories providing more sophisticated products, better quality, and customer relationships based on services will also continue to operate.

However, the problem facing Bangladesh is different.

I suggest the problem is high soft costs. In the new global garment industry, there is a cost to what retailers and their customers consider unethical behavior.

If you do not pay your workers a living wage; if when workers demonstrate for higher wages and better working conditions you negotiate with guns and clubs your customers will go elsewhere, particularly when too many factories everywhere are fighting for too few orders.

If your customers mark your industry as unacceptable, everybody suffers.

The foreign owned factories must consider the added cost of working in Bangladesh. The fact that they pay higher wages and offer better working conditions will no longer count. There will come a point when closing down their Bangladesh branch factories not only becomes necessary, it offers quantifiable benefits, showing that in this new industry when good ethical practices are as important good products, they can no longer accept operating in Bangladesh.

The better locally owned factories will be in a worse position. They will become part of a failed industry but will have no place to run.

Bangladesh has the potential to become an important player once again in the global garment industry. There are still viable strategies to reverse the current downward trend, but time is running out.